Are you a business located outside of Washington State? Are you selling your goods online through Amazon? Are you using Amazon’s fulfillment services that allow Amazon to actively manage your company’s inventory? Have you recently received a letter from the Washington State Department of Revenue inquiring about your activities in Washington state? If so, read on:

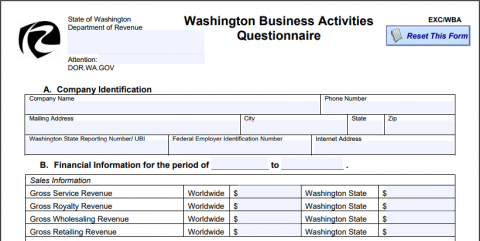

I am referring to the Washington State Business Activities Inquiry letter, which is generally accompanied by a blank questionnaire. You are asked to respond to the inquiry and complete the questionnaire by a certain date. You may be wondering whether this letter is legitimate and why you are being contacted when you have nothing to do with Washington state.

The brief answer is this: If you received such a letter, this means that Washington state is attempting to determine whether you have the required nexus with Washington, and if you do, whether you are required to register with Washington state and collect and remit the Washington state sales tax. The Department also wants to determine whether you owe any tax to Washington for the past seven years (2010 through 2016, plus current 2017 year). The Department may treat you as the “unregistered business” (even though you had no clue that you maybe should have registered), which may the Department the right to go back in time all the way to 2010.

The information regarding physical nexus and economic nexus can be found here: CLICK

It appears that Washington state is actively looking for new sources of revenue, and out-of-state businesses who sell online to Washington customers probably look like a lucrative source of such additional revenue, especially given that Washington has no income tax and thus must rely on sales tax as its source of revenue.

If you were contacted by the Washington State Department of Revenue, the unwise course of action, in my option, would be to simply ignore that letter. You might be thinking that you have nothing to do with Washington, and therefore, why would you even bother responding to the Washington’s inquiry. How would they ever find you or assess any taxes again your business, right? Wrong, unfortunately. The Washington State Department of Revenue has the power to estimate your taxes (if you choose not to respond), in which case you may be forced into the appeals process (or if you do not timely appeal, the Department may proceed with attempting to collect the tax debt that you never knew you owed).

If you need further information, please give me a call today.